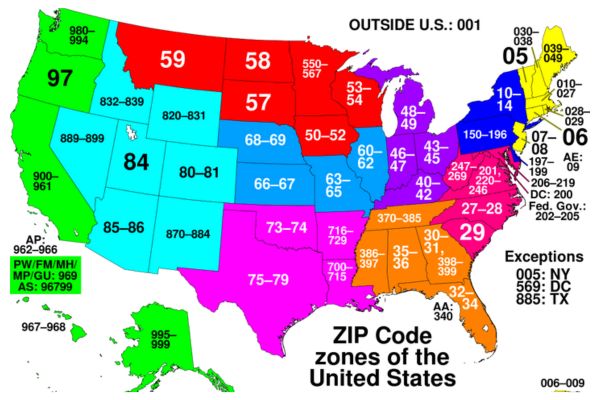

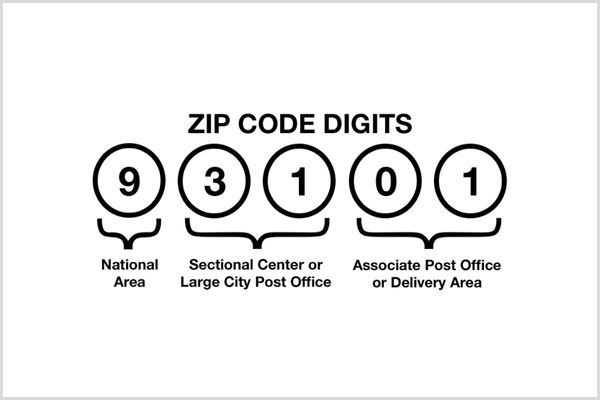

Are you curious to know what is a billing zip code? ZIP code, the short form of the Zone Improvement Plan, is a five-digit number that was introduced in 1964. It was later extended to include four digits immediately following a dash, resulting in the ZIP+4 code. The additional four digits help USPS in better segregation of mail during distribution.

While ZIP codes were initially developed to serve the United States Postal Service (USPS), but a number of other freight companies, such as DHL, FedEx, UPS, and many more, utilized ZIP codes to sort mail and estimate the cost and duration of delivery.

A billing zip code is the place of your residence that you see on your credit card statements. That is where the “Billing ZIP codes” were first employed. Medical professionals could also use it to safeguard your privacy and to identify. The Billing Zip Code is used by credit card companies to determine where invoices from credit cards are issued. The official Bank Zip Code of Your Registered Address is the Billing Zip code. If your credit card is lost or stolen, you can use your billing zip number as a security measure to block unwanted people from purchasing goods using it.

Why do you need Billing Zip Code?

In the event of attempting to perform an online transaction, your debit and credit card’s zip code play a huge role in stopping fraud or protecting your money. A person could gain access to your credit and debit card details if the credit company or bank doesn’t necessitate a zip code as a mandatory requirement. Someone could use your credit card data to commit fraud without you knowing.

The billing zip or code works like the password. It’s like entering a computer password or a password to unlock the screen of your phone. That would make it much more difficult to be stolen if this was not implemented. If your credit or debit card were stolen, it would not be possible to be used due to this upgraded security feature. Similar to how other people can’t access your tablet or phone without knowing the password.

Also Check: 3 Ways to Fix USPS’ Insufficient Address’

Notifications from debit cards for customers are also mailed to that address by their bank or card company, as well as credit union organization. It is important to check and record regularly so that customers know how much money they have in their bank account and the amount they are spending.

Billing Zip Code on Card

If your ZIP code is required, enter the first three numbers of your postal code along with two zeros. If the postal code is 4C5 A8B, for example, the five-digit number you need to enter is 47600. If you encounter any problems, you can get in touch with the bank. Look up the billing history for a credit card that has the aforementioned information. It will be possible to locate it in the record.

Visa Card Billing Zip Code

A variety of credit card companies, including Visa, Dinners Club, Mastercard, and others, use this Visa card’s zip code to identify the billing Zip code. It is the place where Credit Card statements are sent. Visa card zip code can be described as the term used for a zip code.

For certain types of payments, every debit card comes with a zip code linked to the address of the individual that acts as a security code. That is also true in the case of credit cards however not so for gift cards. It is essential to know your zip code since you’ll require it frequently. There are several ways to locate the zip code of your debit card. To protect your credit or debit cards, it comes with a five-digit code known as a zip code that is paired to them. Postcode, billing postcode, or the billing zip code all refer to the identical item.

Some of the purchases, like filling your gas tank, require you to enter the zip code before proceeding. This can be done in lieu of entering a PIN number in certain instances. You may also be required to enter both codes on some occasions. Since it’s linked to the address of payment, the zip code associated with the card should only be accessed by you.

The five-digit zip code isn’t printed on your debit and credit card. It will not be visible on the card or included in the credit card numbers either. This information must be kept private and considered personal information. This stops people from misusing your credit or debit card.

Postal Code

The postal code is allocated to every area. Most have an identifier of five digits based on distinct portions with a four-digit code covering the whole region. This helps in controlling mail and calculating the postage amount on parcels. In a large city, there may be multiple postal codes, each of which identify a distinct section within the town. It’s not uncommon for smaller towns to have one zip code for all residents.

What is the billing postal code?

Now, let’s move on to the billing postal code definition. The billing postal code is the identical PIN code or zip code that appears on your debit or credit statements from banks or cards. That is the address where banks or financial institutions send their credit or debit card declarations. (The address to which your bank statement is delivered).

Billing Postal Code on a Credit Card

The billing postal code on a debit card can be useful in making sure that purchases are secure. Anyone who uses the card should know the postal code of the cardholder used for the billing address when receiving the card. The transaction won’t be accepted by the card provider when you don’t have the following details or if it’s made incorrectly.

To complete the billing process, you’ll have to select a different payment method. If the payment is unsuccessful, the buyer may not realize that they have altered their account details after they transferred. Since a lot of customers receive e-credit card statements and don’t remember to inform their banks the time they transfer funds or when their postal code changes.

The pin code, also known as a ZIP code associated with a credit card’s invoice address, is called the postal code for credit cards, which is the address you enter on the registration form. If you don’t alter or change your information, the bank will keep sending the credit card report and statement of bills to that particular address.

What is the difference between credit card postal codes and debit card postal code?

That is decided by the billing address you use and the postal code you gave to the credit card or bank when you applied for the card. The credit or debit card you use must have unique postal codes if you have selected an individual billing address for each card. Each number must be recorded separately. However, if you’ve used the same billing address for each card, then your debit card and credit account billing address will be the same.

Also Check: